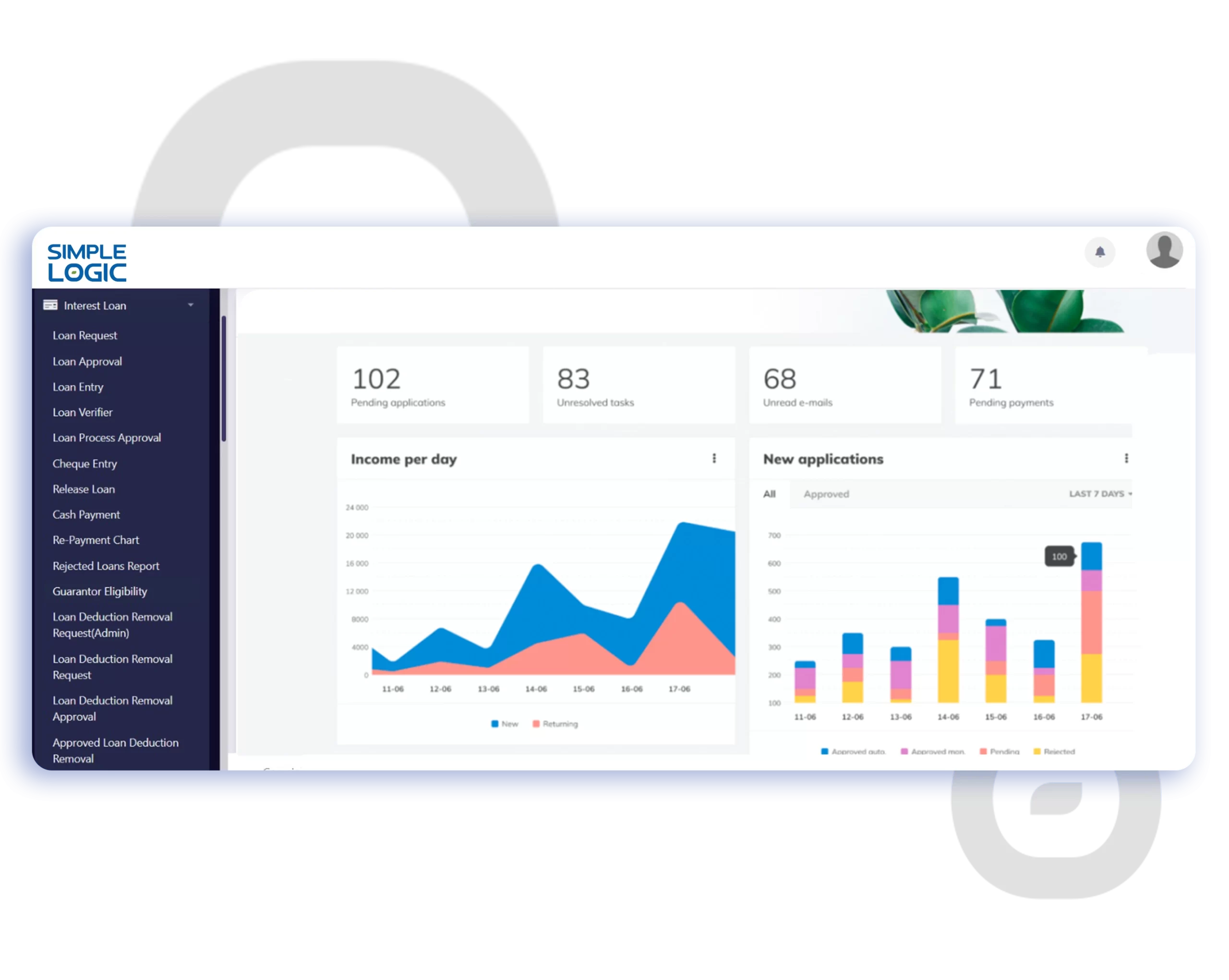

Loan management module of HRMS software UAE

Loan Request & Approval

The Loan Request & Approval feature are used employesstol submit loan applications through the HR or payroll sites. This function is full automated and configurable, this process make sure the efficient workflow of the process

Self-Service Loan Request Submission

Employees can request for a loan by entering details such as loan amount , type, purpose for the loan, period for the loan. They can also upload necessary supporting documents (e.g., salary slips, medical bills).

Customizable Multi-Level Approval Workflow

The system supports a multi layer configure system, this configuration is defined by the employees job designations.

- Level 1: Immediate supervisor

- Level 2: Department head

- Level 3: HR or finance manager

Real-Time Application Tracking

Employees can track their status of the loan in real time, also they can view the stages of approval , pending actions and review or comments.

Automated Notifications & Reminders

The system sends automatic notification to approvers when something is related to their pending approvals.

Integrated with Payroll & Loan Policies

The approval logic can be aligned with company-defined loan eligibility rules such as maximum loan limits, service duration, or salary multiples. Once approved, loan data flows directly into the payroll module for further processing.

Loan Verifier

The loan verifier function plays a critical role for ensuring integrity and compliance of the employee loan process .This feature reviews and validates all aspects of the application before it proceeds.

Role-Based Verifier Assignment

Administrators can assign specific users (e.g., HR, Finance, or Department Heads) as Loan Verifiers.These users can view and verify loan applications.

Automatic Eligibility Check

The system automatically evaluates key criteria, such as:

- Employment duration

- Current salary

- Existing loan obligations

- Loan amount limits

- Company policy compliance

Detailed Document Verification

Verifiers can view and assess documents submitted by the employee, such as:

- Identity proof

- Medical bills (for emergency loans)

- Expense receipts

- Past loan clearance certificates

Financial Review Dashboard

The system provides a consolidated view of each employee:

- Salary and deduction history

- Other outstanding loans

- Previous repayment behavior

- Pending EMI amounts

Approval, Rejection, or Escalation Options

Once the review is complete, the verifier has to check these the following options:

Approve: The loan moves forward in the workflow.

Reject: The application is declined with recorded reason.

Request More Info: The employee is notified to provide missing details.

Escalate: Forward to a higher-level verifier or HR for complex cases.

Notes & Comments Section

Each verifier can leave internal notes or attach comments to the application for future reference. These notes are only visible to authorized reviewers and approvers.

Secure Audit Trail & Compliance Logging

Every action taken by a verifier—viewing, editing, commenting, or status changes—is recorded in the system. This supports HR audits, financial reviews, and legal compliance.

Seamless Integration with Loan Workflow

Once verification is complete, the loan request automatically moves to the next stage in the approval hierarchy, along with a verified tag and any relevant verifier remarks.

Loan Entry & Repayment Chart

The loan Entry & Repayment chart module is the core part of the loan management system.It provides accurate financial tracking and integration with payroll.It enables HR or finance teams to record approved loans, define repayment terms, and generate a clear, automated repayment schedule for each employee.

Centralized Loan Entry System

Once a loan is approved , the administrator can enter all loan details into the system like

- Employee name and ID

- Loan amount sanctioned

- Loan type (advance, emergency, education, etc.)

- Interest rate (if applicable)

- Repayment start and end dates

- Repayment mode (fixed EMI or variable)

Auto-Generated Repayment Schedule

Based on the loan parameters, the system automatically generates chart that includes:

- Total number of installments (monthly/weekly)

- Installment amount breakdown (principal + interest)

- EMI deduction dates

- Outstanding balance after each payment

- Final due date

Real-Time Loan Ledger Maintenance

A live loan ledger tracks:

- Each EMI deducted

- Payment dates

- Any missed or adjusted payments

- Changes in tenure or installment amount (if modified)

The ledger provides a complete view of the loan status—updated in real-time as repayments occur through payroll deductions or manual entries.

Integration with Payroll

The repayment chart is tightly integrated with the payroll module. Each installment is:

- Automatically deducted from the employee’s salary

- Reflected in pay slips with full transparency

Adjusted in case of unpaid leave or salary revisions

Early Repayment & Restructuring Support

The system allows for:

- Pre-closure of loans if employees repay the remaining amount early

- Loan restructuring, such as extending the term or reducing EMI during financial hardship

- Auto-recalculation of the repayment chart if terms are modified

Alerts & Notifications

Automatic alerts are sent to both employees and HR/finance teams:

- Before each EMI deduction

- In case of missed or partial payments

- When the loan is fully repaid

Reporting & Export Options

Admins can generate detailed reports such as:

- Active loans by department

- Total loan liabilities

- Overdue EMIs

- Loan-wise payment history

Cash Payment & Loan Disbursement

The cash payment & Loan Disbursement module is the final stage of the loan process. Ensuring that approved loan amounts are released safe and securely.

Flexible Disbursement Modes

Once a loan is approved, the system supports multiple payment methods for releasing funds to the employee:

- Bank Transfer – Direct deposit to the employee’s bank account

- Cash Payment – With acknowledgement and reference tracking

- Cheque Issuance – Including cheque number and clearance date

Payment Schedule & Batch Disbursement

For companies that process loans in batches (e.g., monthly or project-based):

- The system allows bulk release of loans to multiple employees at once

- Payment files can be exported for bank submission (in formats like SIF for UAE WPS)

- Scheduled disbursements can be planned for future dates, especially for salary advance loans

Disbursement History & Audit Trail

Every loan payment is logged with key details:

- Disbursement date & time

- Amount released

- Mode of payment

- Transaction ID or bank reference number

- Name of the person who authorized and released the funds

Acknowledgement Receipts

Once payment is released:

- The system can generate a digital acknowledgement receipt for the employee

- Employees receive a confirmation via email or portal notification

- For cash payments, the system can include space for digital signatures or scanned copies of signed receipts

Integration with Financial Accounts & Payroll

Released loan amounts are linked with financial and payroll systems to:

- Reflect loan disbursements as liabilities in accounting

- Update the employee’s loan ledger in real-time

Trigger the start of repayment based on disbursement date

Exception Handling & Manual Overrides

In case of failed bank transactions or cash handling errors:

- Admins can manually mark a loan as “Disbursed” or “On Hold”

- Reason codes (e.g., account closed, employee unavailable, etc.) can be added

Retry mechanisms or alternate modes can be selected for reprocessing

Reporting & Compliance Logs

The system provides detailed reports such as:

- Disbursed loans within a date range

- Pending disbursements

- Cash vs. Bank disbursement breakdown

- Department-wise or employee-wise payment history

Easy Solution For All HR Needs

IBIZ HRMS provides an all-in-one experience that brings payroll, attendance management, benefits administration, hiring, and other core HR functions into a single platform. The well-designed features empower you by simplifying the daily activities and keeping the fun of HR alive. HRMS software takes HR processes many steps forward with advanced features such as Advanced Attendance Management System, Approval Process Flow, Self Service Portal, Interactive Dashboards, Mobility and customizable modules etc. It delivers superior employee experiences by helping people to engage continuously and be productive. It aligns a company’s people strategy to support its evolving business strategy, adjusting to the ever-accelerating changes in the business. landscape.

Why Choose Simple Logic’s HRMS Software in UAE?

Seamless integration with payroll and legacy HR systems

Cloud-based and on-premise deployment flexibility

Supports multi-location and multi-device acces

Designed to comply with UAE labor law

Offers a secure employee self-service portal

Trusted by HR departments across the UAE and GCC

Whether you’re looking to modernize your HR processes or scale efficiently, Simple Logic provides the best HRMS software in the UAE—built for performance, compliance, and business agility.