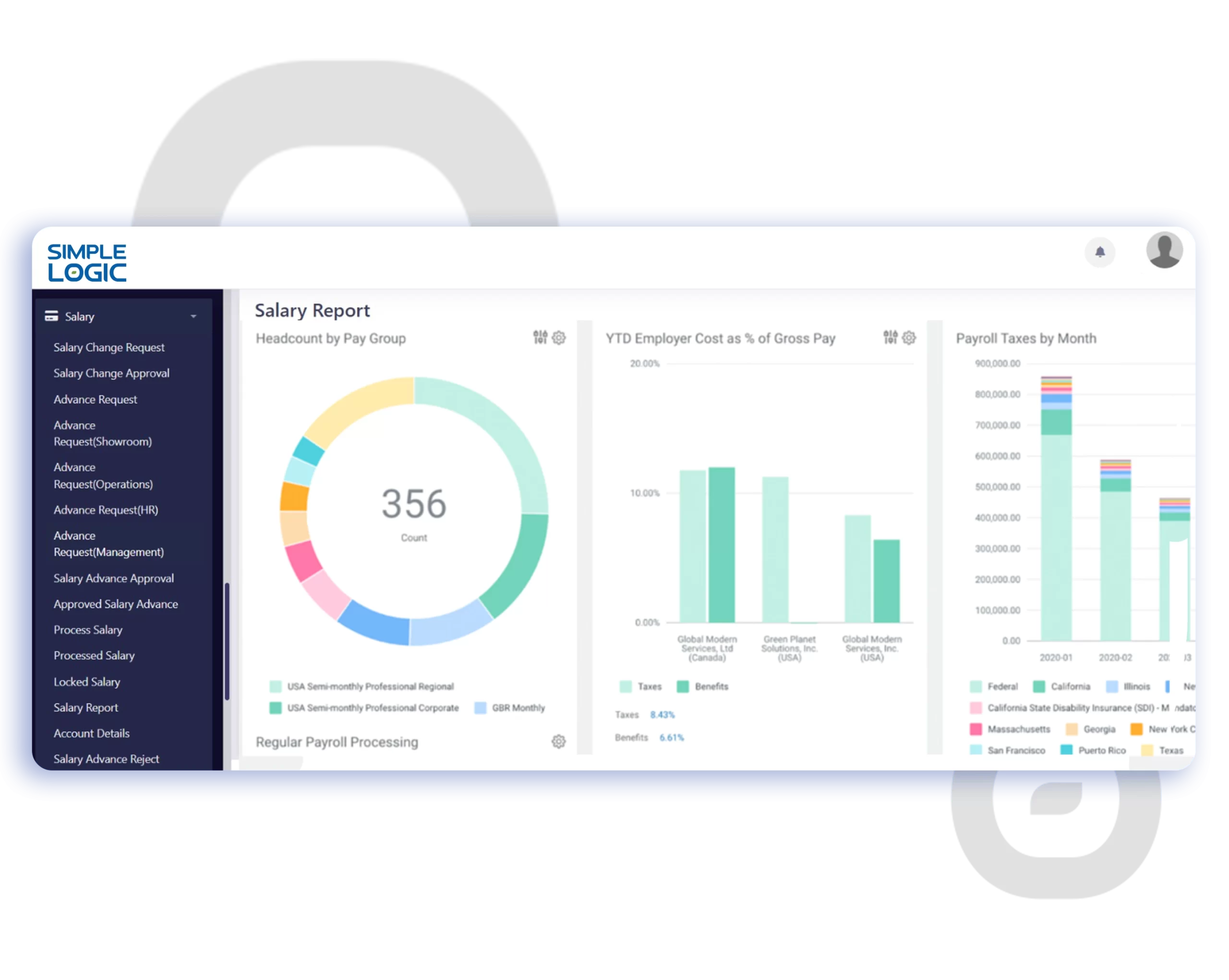

Payroll management module of HRMS soft

HR and Payroll Software Dubai| UAE

Payroll Management is one of the most important features in an organization.It involves not just calculating salaries but also handling statutory deductions, bonuses, reimbursements, tax regulations, and legal reporting. Any errors in this process can lead to a big mistake.Our system is designed to streamline and simplify the entire payroll workflow—ensuring that HR teams can manage it with confidence, accuracy, and efficiency.

Set Pay Policy

This Feature allows HR and payroll administrators to manage ,optimize and enforce payroll rules that align with the company’s compensation policy, industry policy, and local labor laws. This ensures consistency, transparency, and legal compliance are directly connected to the employees salary structure.

2. Salary Band Configuration:

- Define salary ranges for different job position employees, departments, or employee levels.

- Helps to make fair and consistent compensation across similar roles.

- Supports career progression and promotion

2. Allowance Management:

- Configure a wide range of fixed or variable allowances such as:

- Housing allowance

- Transport allowance

- Travel or mobile reimbursements

- Meal or uniform allowances

- Hardship or risk pay (if applicable)

- Set eligibility rules based on location, job title, contract type, or seniority.

- Configure a wide range of fixed or variable allowances such as:

3. Payroll Rules & Payment Policies:

- Define pay frequencies (monthly, bi-weekly), cutoff dates, and payout schedules

- Set rules for overtime pay, leave encashment, bonus calculations, and salary advances

- Automate compliance with UAE Wage Protection System (WPS) and other regulatory requirements.

4. Tax & Deduction Configuration:

- Although the UAE currently has no personal income tax, this feature supports tax deduction settings for companies operating in other tax jurisdictions or offering international payroll.

- Configure statutory or voluntary deductions such as:

- Social security contributions

- Gratuity provisions

- Pension schemes

- Employee loans or advances

5. Custom Components & Flexibility:

- Add custom pay heads.

- Define whether components are taxable, fixed, or dependent on performance.

- Manage one-time settlement.

Define Pay Components

The Define Pay Components on HRMS, This Feature allows HR and payroll administrators to create, manage,update and assign various salary elements—both getting and lost—to make a structured and transparent payroll process system . These components can be customized to fit your organization’s salary policies, benefits schemes, and legally.

1.Creation of Earning Components:

- Define various income components of the employee, including:

- Basic Salary – The fixed, core part of pay.

- House Rent Allowance (HRA) – Common in UAE and other regions to support housing expenses.

- Conveyance/Transport Allowance – To cover commuting costs.

- Special/Performance Allowances – For bonuses, productivity incentives, or job-specific pay.

- Overtime Payment – Automatically calculated based on logged hours and company rules.

- Commission, Sales Incentives, and Holiday Pay – Variable earnings tied to role and output.

- Each component can be tagged as fixed or variable, taxable or non-taxable, and assigned specific calculation logic.

2. Deduction Components:

- Set up recurring or one-time deductions such as:

- Tax Deductions (in regions where applicable)

- Social Security or Pension Contributions

- Employee Loans/Advances Recovery

- Gratuity Deductions

- Unpaid Leave Deductions

- Other Voluntary or Statutory Deductions

3.Custom Rule Assignments:

- Apply conditions or formulas to each component (e.g., HRA as 40% of Basic Salary).

- Control visibility and applicability of components based on employee role, grade, location, or contract type.

- Define whether the component affects gross salary, net pay, or benefits calculations.

4.Component Grouping & Templates:

- Group multiple components into salary structure templates for easy assignment to employee categories.

- Helps HR quickly onboard new employees with predefined pay packages.

5. Real-Time Integration with Payroll & Reports:

- All defined components feed directly into the payroll engine.

- Ensures accurate salary calculations, payslips, payroll summaries, and tax filings.

- Components are traceable in reports and help with audit and compliance tracking.

WPS Recovery & Report

The WPS Recovery & Report process is especially designed for businesses operating in the UAE to ensure full compliance with the Wage Protection System (WPS)- In UAE there is a mandatory salary transfer system, so they can transfer wages of employees without any delay. This feature automates the generation of WPS compliant reports and secure SIF formats.

- Automated WPS File Generation (SIF Format):

- Generates the Salary Information File (SIF) in the exact format required by the UAE Central Bank.

- Includes all mandatory details such as:

- Employee ID (as per MOL records)

- IBAN/account number

- Net salary payable

- Salary month and year

- Payment frequency

2. WPS Recovery Reports:

- Automatically compiles records of past salary transactions, including successful and failed WPS transfers.

- Helps identify and recover missed or failed payments due to issues like invalid bank accounts, salary mismatches, or employee resignations.

3. Error Validation & Alerts:

- Built-in checks flag missing employee data, incorrect formats, or non-compliance before the SIF file is generated.

- Notifies HR teams of required corrections to prevent WPS rejection.

4.Secure & Compliant File Management:

- WPS files are generated securely and stored with audit trails.

- Supports multi-level approval workflows before final submission to the bank or WPS agent.

5. Integration with Payroll System:

- Pulls approved salary data directly from the payroll module.

- Ensures that all payments reflect actual earnings, deductions, leaves, and adjustments for the payroll period.

6. Submission Tracking & Documentation:

- Tracks WPS file submissions to your designated bank or exchange house.

- Keeps archived reports for monthly submissions, ready for audit or inspection by MOHRE.

Collect Payroll Inputs

Collecting payroll details is a standard step for providing accurate and timely salary processing.This feature allows your HR or payroll team to automatically collect the details of the employee like time logs, attendance reports, leave balance, overtime payment from integrated modules or systems. It deletes the manual data collection.

1.Integration with Time & Attendance Systems:

- Automatically syncs employee check-in/check-out data, working hours, late arrivals, early departures, and overtime from biometric systems, geofencing apps, or RFID-based attendance solutions.

- Helps calculate actual hours worked versus scheduled hours for precise salary computation.

2. Leave & Absence Data Collection:

- Gathers approved leave requests (sick, annual, unpaid, etc.), holiday entitlements, and absence records.

- Ensures that paid and unpaid leave are accurately reflected in the payroll.

3. Shift & Scheduling Inputs:

- Consider shift differentials, night shift allowances, and multi-location work hours.

- Captures any additional allowances or deductions tied to specific shifts or rotations.

4. Real-Time Input Validation:

- Validates collected inputs for inconsistencies, missing data, or conflicts (e.g., unapproved leave, duplicate entries).

- Provides alerts to HR/admin for correction before final payroll processing.

5. Payroll Adjustment Inputs:

- Captures other data like:

- Bonuses or incentives

- Reimbursements (travel, meal, mobile, etc.)

- One-time payments (joining bonus, exit payouts)

- Deductions (loan EMIs, late penalties, salary advances)

6. Approval Workflows:

- Allows inputs to be reviewed and approved by department heads or HR before processing salaries.

- Ensures accountability and proper authorization.

7. Audit Trail & Historical Logs:

- Maintains a transparent log of all payroll input data, including timestamps and approver details.

- Supports audits and dispute resolution with full traceability.

Distribute Pay slips

The Distribute Payslips function is the process of creating and sharing detailed salary statements with employees after payroll is processed. It provides timely and secure delivery of payslips via employee self service portals or email, it assuured the full visibility into their earnings , deductions and tax details payment cycle.

1. Automated Pay slip Generation:

- Once payroll is fixec , the system automatically generates individualized payslips for all employees of the organization.

- Each payslip includes detailed breakdowns of:

- Earnings (Basic pay, allowances, bonuses)

- Deductions (Loans, unpaid leaves, statutory deductions)

- Net Pay

- Tax and Contribution Details (if applicable)

- Leave Balance and payment period coverage

2. Email Distribution:

- Pay slips are automatically emailed to each employee’s mail.

- Emails are secured with a password.

- Customizable email templates can include your company branding, support contact, and instructions.

3. Employee Self-Service Portal Access:

- Employees can enter into a secure web or mobile portal at any time and view their payment slips.

- Provides 24/7 access and reduces dependency on HR for routine requests.

4. Digital Signature and Approval:

- HR or finance teams can digitally sign pay slips before distribution for authenticity and compliance.

- Some systems offer manager-level approval before final release to employees.

5. History and Archiving:

- Pay slips are securely archived for statutory retention and audit purposes methods.

- Employees and HR can access historical records if required.

6. Compliance with UAE Labor Laws:

- Pay slips are designed to meet legal format method and content standards.

- Supports WPS-compliant reporting system

7. Multi-Language and Multi-Currency Support:

- Pay slips can be customized by language.

Easy Solution For All HR Needs

IBIZ HRMS provides an all-in-one experience that brings payroll, attendance management, benefits administration, hiring, and other core HR functions into a single platform. The well-designed features empower you by simplifying the daily activities and keeping the fun of HR alive. HRMS software takes HR processes many steps forward with advanced features such as Advanced Attendance Management System, Approval Process Flow, Self Service Portal, Interactive Dashboards, Mobility and customizable modules etc. It delivers superior employee experiences by helping people to engage continuously and be productive. It aligns a company’s people strategy to support its evolving business strategy, adjusting to the ever-accelerating changes in the business. landscape.

Why Choose Simple Logic’s HRMS Software in UAE?

Seamless integration with payroll and legacy HR systems

Cloud-based and on-premise deployment flexibility

Supports multi-location and multi-device acces

Designed to comply with UAE labor law

Offers a secure employee self-service portal

Trusted by HR departments across the UAE and GCC

Whether you’re looking to modernize your HR processes or scale efficiently, Simple Logic provides the best HRMS software in the UAE—built for performance, compliance, and business agility.